- One Percent

- Posts

- 🤖 Dw they're not coming for your jobs

🤖 Dw they're not coming for your jobs

Formic

Robots aren’t coming for your jobs, relax.

Here we go, welcome my curious friends. Today we’re learning about Formic, the robotics-as-a-service (SaaS? Nah, RaaS) company.

You can think of Formic as an employment agency to manufacturing firms, but instead of employees, they send robots.

Macro

Let’s start at the way, way top. There are two massive tailwinds I predict Formic is riding:

De-Globalization

China’s Aging Demographic

De-Globalization

Our global supply chain was thrown a curve ball.

The leading two causes were:

Safety precautions from the pandemic reduced the available workforce

Infinite money supply in tandem with buy-now-pay-later companies dramatically increased consumer purchasing power

Many companies with oversees manufacturing operations were put in an impossible situation — high demand, but no way to get supply. Crazy thing is, the labor shortage was just the first shoe to drop. The downstream effects were even more damning.

Journey time from Asia to North America went from ~51 days in January 2020 to ~113 days at its peak in January 2022.

On top of that, the cost per container (TEU) went from $1,000/TEU in January 2020 to $5,110/TEU at its peak in January 2022.

Imagine you running a company and your costs 5x over night, completely messes up the economics. All this to say, the past two years revealed how fragile the global supply chain is.

The solution? Bring manufacturing in-house.

China's Aging Demographic

It's probably no surprise that manufacturing makes up over a quarter of Chinese GDP.

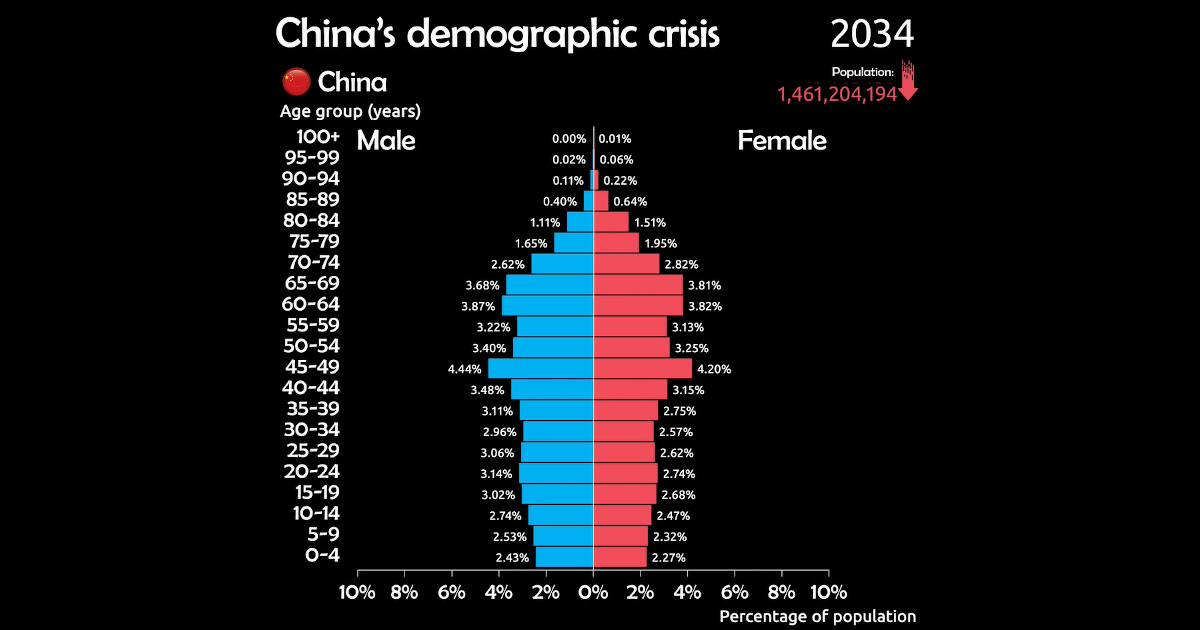

But the real insight here is the aging demographic of the population.

Watch the aging demographic of their population from 1950 onward

With an aging population, China will have an unprecedented number of openings for their manufacturing jobs. That equates to their largest percentage of GDP being unequipped with labor to support. This will probably inadvertently dent their economy.

With that backdrop, Formic looks like it's operating at an opportune time. There's clearly demand and they are in a position to aid American exceptionalism.

Manufacturing Facilities

Alright, we know they’re got massive tailwinds, but is there really value in substituting human labor with robots?

Let’s hop into how the financials of a manufacturing facility work:

Revenue — Presumably increasing year-over-year via increased demand

COGS — Supplies used to create the product (variable expense contingent on demand)

Operating Expenses —

Rent — Fixed monthly cost

Labor — Variable cost

Marketing — Variable cost

Interest Expense — Interest payments on debt obligations

Taxes — Federally set

Net Income — Amount of money the company made after expenses

Now that we’ve got a reference to a shell of a manufacturer’s P&L, let’s take a look. A manufacturer can continue to grow in so far as demand is met with supply. However, the supply component is the most difficult thing to get right. If the company wants to meet demand, it can only do so within the bounds of 8 hours a day, 5 days a week, and how fast they can hire. If you think about that, the ultimate limiter of the manufacturing facility is labor. Ultimately, production capacity is capped in so far as humans are involved in the process. Formic is working on substituting the variable labor component of a manufacturer’s P&L with their robotics as a fixed cost + almost doubling production capacity over night (bc robots can work 24/7).

Formic’s Business Model

A manufacturer will request a robot from Formic. Formic will then turn around and acquire a robot from an original equipment manufacturer (OEM), make iterations specific to the client's needs, and lease it on a contractual hourly basis to the manufacturer. Kind of like an employee - paid by the hour.

The genius of it comes from how they are secretly building an arsenal of the largest robotic workforce. At the point a manufacturer requests a robot from Formic, they sign a contract indicating how much they’ll pay over the course of the year and for how long. Think of it like an employment contract. Formic will then use that employment contract as proof of funds in tandem with their existing equipment as collateral and receive funding from a bank to purchase a robot from an OEM. Over the course of the next couple years, Formic pays down their debt from the leasing contract. By the end, at the minimum, they own the robot purchased from the OEM, and at the maximum, the customer extends their contract — at which point every dollar from that engagement goes into Formic’s pocket.

Each incremental customer increases their arsenal, credit worthiness, and diversity of product.

Genius.

Early Investors

Special shoutout to the Seed investors in Formic.

Initialized Capital

Lorimer Ventures

Lux Capital

Correlation Ventures

Ali Tamaseb

Series A round was led by Lux Capital in 2022.

Let's Get You Employed 💼

Stuff they're doing sound interesting? Throw your hat in the ring.

SK's Weekly Rec 🤔

Big BG

Mr. Dalio

Weekly Banger

Catch y'all next time inspiration hits. Till then, chirp at me on the bird app.

Cheers,

SK – A writer with a curious mind and an appreciation for novelty.